Inter bank participation certificates PowerPoint PPT Presentations, Inter bank participation certificates PPTs

Contents:

House bills and bills of finance companies are not eligible as cover for BRDS. Ltd. or such other credit rating agencies as may be specified by the Reserve Bank of India from time to time, for the purpose. Physical CDs are freely transferable by endorsement and delivery. Demat CDs can be transferred as per the procedure applicable to other demat securities. Currently, as per RBI guidelines Banks/FIs should issue CDs only in the demat form.

In addition, if bonds are held to maturity, then an investor receives back the full principal amount. Bonds are a way to receive income while preserving the initial investment. As opposed to bond participation, COPs pay investors via lease revenues as opposed to bond interest. These guidelines are subject to any instructions that may be issued by the RBI from time to time.

It is customary to nominate a trustee, often an funding bank- to protect the interests of the debenture holders. This is necessary as debenture deed would specify the rights of the debenture holders and the obligations of the corporate. “I had my eye on capital and after RBI came out with the AQR, I was not certain as to where we would stand with regard to capital,” Rego said. According to him, the bank sold Inter Bank Participation Certificates of close to Rs 8,000 crore which also led to the the shrinkage of the balance sheet. Public sector lender Bank of India sold loans worth Rs 8,000 crore to various banks under the Inter Bank Participation Certificates scheme, preempting a capital crunch following the Reserve Bank of India’s cleanup drive, MD & CEO Melwyn Rego told FE. “The introduction of PSLCs in the early part of fiscal 2017 is estimated to have had a negative impact on both securitisation and inter-bank participation certificate volumes.

Participatory certificates get priority lending standing

Cuinter bank participation certificated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more. The primary objective of the Participations is to provide some degree of flexibility in the credit portfolio of banks and to smoothen the working of consortium arrangements. Tax-advantaged refers to any type of investment, account, or plan that is either exempt from taxation, tax-deferred, or offers other types of tax benefits. COPs are commonly found in municipal financing as an alternative to muni bonds. Sector and the banks fulfill the Reserve Bank guidelines on IBPCs.

CP may be issued on a single date or in parts on different dates provided that in the latter case, each CP shall have the same maturity date. Every issue of CP, including renewal, should be treated as a fresh issue. The borrowal account of the company is classified as a Standard Asset by the financing bank/s/institution/s. In a Reporting fortnight the average lending by a bank cannot exceed 25% of its Tier 1 + Tier 2 Capital as of the previous financial year; and on any given day the lending should not exceed 50% of the same. Tradable Priority Sector Lending Certificates was first proposed by A.M. Godbole had called tradable Priority Sector Lending Certificates as ‘social credits’.

PRINCIPAL FINANCIAL GROUP INC Management’s Discussion and … – Marketscreener.com

PRINCIPAL FINANCIAL GROUP INC Management’s Discussion and ….

Posted: Wed, 03 May 2023 18:58:03 GMT [source]

Under the agreement, the local government makes regular payments over the annually renewable contract for the acquisition and use of the property. A lease-financing contract is typically made available in the form of a certificate of participation. Export Credit extended by foreign banks with less than 20 branches will be reckoned for priority sector target achievement. Medium & long-term loans to farmers for agriculture and allied activities (e.g. purchase of agricultural implements and machinery, loans for irrigation and other developmental activities undertaken in the farm, and development loans for allied activities). Advances to micro and small enterprises sector will be reckoned in computing achievement under the overall priority sector target of 40 percent of ANBC or credit equivalent amount of Off-Balance Sheet Exposure, whichever is higher.

The rates will be low in easy money market and the rates would be high in tight money market. A liquid market can turn tight even overnight due to sudden changes in the financial environment, the policy of the central monetary authority or the Government or even other external factors which have an impact on the financial market. The selling or purchase of Priority Sector Lending Certificates does not cause a transfer of credit risk as Priority Sector Lending Certificates do not cause any change in the lender of any loan i.e. the lender is not replaced.

Other factors that may affect the repo rate include, the creditworthiness of the borrower, liquidity of the collateral and comparable rates of other money market instruments. Treasury bill is a short-term money market instrument issued by the Government of India through the RBI. The GOI issue T-Bills for tenures of 14 days, 28 days, 91 days, 182 days and 364 days. Reserve Bank of India Deputy Governor R. Gandhi said that “PSL certificates, which will be eligible for classification under respective categories of priority sector, bought by banks, may dent the growth of securitised market.” No reason has been shared for this assertion. The current RBI tips mandate that a minimum of forty per cent of the net financial institution credit score be earmarked for certain designated sectors, which include exports, housing, rural and agriculture sectors.

Describe the role played by Bank in the foreign exchange market. Briefly discuss the different types of ‘Foreign Exchang

It is essentially a lending and borrowing transaction at an agreed rate of interest known as repo rate. Banks, in their normal course of business discount bills of exchange. To provide liquidity and to promote the bills culture in the economy, the RBI formulated a scheme whereby a bank may raise funds by issue of Usance Promissory Notes in convenient lots and maturities on the strength of genuine trade bills discounted by it. Therefore banks look at FDs if they can lock the funds for a period. FDs are mentioned here as it is a short-term alternate investment option and it does have limited liquidity in the sense that the investor can redeem the FD at the bank at any point in time.

Securities are usually categorized into ownership securities and creditorship securities. The Crisil study showed that around 55% of the PSLCs traded are related to loans to small and marginal farmers. The misclassifications reported by the Reserve Bank’s Department of Banking Supervision would be adjusted/ reduced from the achievement of that year, to which the amount of declassification/ misclassification pertains, for allocation to various funds in subsequent years. The eligible loan assets so purchased should not be disposed of other than by way of repayment. Loans to MFIs for on-lending to farmers for agricultural and allied activities as per the conditions specified in paragraph VIII of this circular.

Participatory certificates get priority lending status

Loans to persons involved in assisting the decentralized sector in the supply of inputs to and marketing of outputs of artisans, village and cottage industries. Loans for food and agro processing will be classified under Micro and Small Enterprises, provided the units satisfy investments criteria prescribed for Micro and Small Enterprises, as provided in MSMED Act, 2006. The manufacturer company provides the maintenance service to their buyers for their valuable products.

Where this is not realized, the instrument mainly becomes a mechanism for obtaining additional resources rather than to share the advances as part of evening out liquidity. The securitised assets are originated by banks and financial institutions and are eligible to be classified as priority sector advances prior to securitisation and fulfil the Reserve Bank of India guidelines on securitisation. All types of loans, investments or any other item which are treated as eligible for classifications under priority sector target/sub-target achievement should also form part of Adjusted Net Bank Credit. For foreign banks with 20 and above branches, priority sector targets and sub-targets have to be achieved within a maximum period of five years starting from April 1, 2013 and ending on March 31, 2018 as per the action plans submitted by them as approved by RBI. Any subsequent reference to these banks in the circular, will be in accordance to the approved plans.

- Ltd. or such other credit rating agencies as may be specified by the Reserve Bank of India from time to time, for the purpose.

- Every issue of CP, including renewal, should be treated as a fresh issue.

- Of this, indirect lending in excess of 4.5% of ANBC or credit equivalent amount of Off-Balance Sheet Exposure, whichever is higher, will not be reckoned for computing achievement under 18 percent target.

- However in the Indian money market Call/Notice money refers to that transaction wherein the money is lent/borrowed between participants, permitted to operate in the Call/Notice money market, for tenors ranging from overnight to transactions to a maximum of fourteen days.

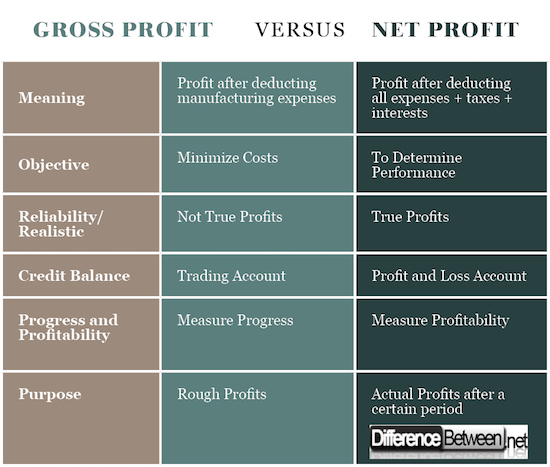

IBPC is yet another short-term money market instrument whereby the banks can raise money/deploy short-term surplus. In the case of IBPC the borrowing bank passes/sells on the loans and credit that it has in its book, for a temporary period, to the lending bank. Bonds are debt instruments which are issued by firms/governments to raise funds for financing their capital requirements.

Explain the factors determining cash reserves of banks.

Loans to distressed farmers indebted to non-institutional lenders. Loans to small and marginal farmers for purchase of land for agricultural purposes. Loans to farmers for pre and post-harvest activities, viz., spraying, weeding, harvesting, sorting, grading and transporting of their own farm produce. 10 percent of ANBC or credit equivalent amount of Off-Balance Sheet Exposure, whichever is higher.

View Inter bank participation certificates PowerPoint presentations online in SlideServe. SlideServe has a very huge collection of Inter bank participation certificates PowerPoint presentations. You can view or download Inter bank participation certificates presentations for your school assignment or business presentation. A certificate of participation is a type of financing where an investor purchases a share of the lease revenues of a program rather than the bond being secured by those revenues.

The deposits under the various Funds will be called upon by NABARD or such other Financial Institutions as per the terms and conditions of the scheme. The assignments/Outright purchases of eligible priority sector loans from MFIs, which comply with the guidelines in Paragraph VIII of this circular are exempted from this interest rate cap as there are separate caps on margin and interest rate. Export credit to eligible activities under agriculture and MSE will be reckoned for priority sector lending under respective categories. The revised guidelines are operational with effect from July 20, 2012. The priority sector loans sanctioned under the guidelines issued prior to this date will continue to be classified under priority sector till maturity/renewal. The interbank money market is a market in which banks extend loans to one another for a specified term.

HDFC’s reserves to help HDFC Bank meet regulatory ratios post-merger – BusinessLine

HDFC’s reserves to help HDFC Bank meet regulatory ratios post-merger.

Posted: Sun, 23 Apr 2023 07:00:00 GMT [source]

Investors that participate in the program are given a certificate that entitles each investor to a share, or participation, in the revenue generated from the lease-purchase of the property or equipment to which the COP is tied. The lease and lease payments are passed through the lessor to the trustee, who oversees the distribution of the payment to the certificate holders on a pro-rata basis. A certificate of participation allows investors to participate in a pro-rata share of a lease-financing agreement.

Corporate Bonds – are debt securities issued by public or non-public companies that need to raise cash for working capital or for capital expenditure needs. In Indian parlance, debentures are issued by corporates and bonds by authorities or semi-authorities bodies. But now, corporates are also issuing bonds which carry comparatively lower interest rates and desire in compensation on the time of winding up, evaluating to debentures. It is a debt instrument issued by an organization with a promise to pay curiosity and repay the principal on maturity.

By purchasing a bond, an investor lends cash for a fixed time frame at a predetermined interest price. Bonds have a hard and fast face value, which is the quantity to be returned to the investor upon maturity of the bond. Participants within the LAF market are those that are indicated by RBI. In a strict sense a fixed deposit is not a money market instrument since it cannot be traded.

HDFC Bank posts 23.5 pc loan growth in second quarter – Economic Times

HDFC Bank posts 23.5 pc loan growth in second quarter.

Posted: Tue, 04 Oct 2022 07:00:00 GMT [source]

The tips prescribe that at least 18 per cent of the online financial institution credit be earmarked completely for agriculture. For international banks, the priority sector lending goal has been mounted at 32 per cent. A company can raise money by selling shares to investors and its existing shares may be bought or bought. Without financial markets, debtors would have issue finding lenders themselves.

- Further, the banks have to ensure that MFIs comply with the following caps on margin and interest rate as also other ‘pricing guidelines’, to be eligible to classify these loans as priority sector loans.

- In a COP program, a trustee is typically appointed to issue the securities that represent a percentage interest in the right to receive payments from the local government under the lease-purchase contract.

- This is done when funds are available for a specified period and rate in FD market is more favourable than other markets.

- The priority sector loans of public sector banks act as the underlying belongings for the IBPCs.

- Only three components are to be included in pricing of loans viz., a processing fee not exceeding 1% of the gross loan amount, the interest charge and the insurance premium.

Priority Sector Lending Certificates is different from Securitization as the latter involves a transfer of credit risk. “Priority Sector Lending Certificates may be used in conjunction with inter-bank Participation Certificates or securitization of priority-sector lending portfolios”. Bonds issued by corporates and the Government of India can be traded within the secondary market. Such shares can be transformed to fairness shares at the possibility of the holder. Sec 2 of the Companies Act, 1956 states that debenture contains debenture inventory, bonds and other securities of an organization.

In a repo transaction there is a spot sale and a forward purchase. These transactions are complete when SGLs are exchanged or transfer in demat form is complete and the ownership of the securities is transferred to the buyer for the period of repo and sold back to the seller at the end of the agreed period. Under a repo transaction, a holder of securities sells them to an investor with an agreement to repurchase back the same securities for a same amount at a predetermined date.

この記事へのコメントはありません。