Journal entries for inventory transactions

Content

Adjusting entry for inventory is made at the end of an accounting period to ensure that a company’s recorded inventory tally with the actual inventory on the ground. The adjustments to the journal entry for inventory enable companies to monitor any increase or decrease in inventory. This means that when the adjusting entry for inventory is not properly made, the company’s financial statements will be negatively affected. Inventory adjustment journal entries are necessary to ensure that your inventory records accurately reflect your physical stock.

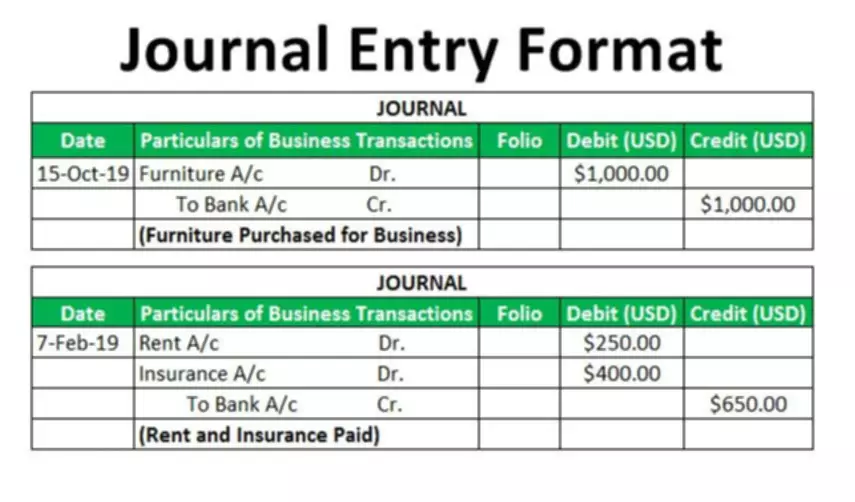

The physical inventory results directly impact the unit’s cost of goods sold, revenue, and profit, and ultimately, the information presented on the university’s financial statements. Inventory purchases are recorded as a charge (debit – D) in the sales operating account on an Inventory object code. An adjusting entry for inventory is a journal entry that is meant to correct any discrepancies between the recorded inventory and the actual inventory. When you enter the inventory adjustment, the system creates a journal entry for both the debit and credit amounts to balance to zero. When the system generates the voucher, it generates a journal entry for the expense.

What are inventory adjustments?

Also, throughout the month I have to write off inventories due to damage or shrink. The amount of closing merchandise inventory is deducted from the cost of goods available for sale in the income statement. Debits increase asset and expense accounts and decrease revenue, liability and shareholders’ equity accounts. Credits decrease asset and expense accounts and increase revenue, liability and shareholders’ equity accounts. We need to use the financial information to determine the ending inventory per inventory system first, and then compare that balance to ending inventory per the physical inventory count.

Combined, these two adjusting entries update the inventory account’s balance and, until closing entries are made, leave income summary with a balance that reflects the increase or decrease in inventory. An inventory change account is credited with a decrease or debited for an increase. When the firm’s income statement and balance sheet are prepared using the adjusted accounts, the new totals report the value of inventory owned. When inventory items are written on, they are available for sale or production, so they must be added as assets in the Inventory on hand account.

Move Raw Materials to Work in Process

Breakage could occur in companies that produce items that could be affected either due to a fall or some other reasons that may make them break. When a company uses some of its inventory, that part has to be accounted for too as “internal use”. Adjusting entries for inventory due to reasons other than shrinkage, breakage, internal use, or waste is written off and thus, recorded as write-offs. The adjustments of inventory can be made at varying times depending on the accounting method used by the company. At the end of the year the accountants need to appropriately allocate payroll expenses, plus taxes due and payable.

What would the debit or credit to the direct material efficiency variance account be for the current… Adjusting entries should not be confused with correcting entries, which are used to correct an error. That should be done separately from adjusting entries, so there is no confusion between the two, and a clear audit trail will be left behind in the books and records documenting the corrections. COGSThe Cost of Goods Sold is the cumulative total of direct costs incurred for the goods or services sold, including direct expenses like raw material, direct labour cost and other direct costs.

Periodic Inventory Method

Closing stock is used in the balance sheet, income statement and Cash Flow statement of a company. It can appear on the balance sheet under “inventory” or “stock in trade” where it would be stated as what the companies adjusting entries current inventory is valued at. Also, if a business sells items that are not part of its normal operations then it may have inventory that is not normal for it to have, this would be considered closing stock.

この記事へのコメントはありません。