Church Accounting, Bookkeeping & Payroll

Otherwise, it is suggested that you contact a reliable CPA and create an informal relationship with them to help you with the finances from an accounting point of view. This matter can enhance your confidence to perform the tasks even better. Keep in mind that you are not allowed to share the financial information of the church with the public, or even with a non-authorized church member.

Responses to e-Support Tickets will occur typically within one (1) business day. Even if you are using an app to handle your bookkeeping, you still have to reconcile your books. When you reconcile your books frequently, you can reduce errors to the barest minimum.

Bookkeeping for Churches: Best Practices, Tips, Resources, FAQs

To build this top 10 list, I evaluated and compared a wide range of church accounting software with positive user ratings. Sage Intacct can automate many financial processes, such as invoicing, purchasing, and revenue recognition, which can save time and improve efficiency. Here’s a brief description of each of the church accounting software on my list, showing what it does best, plus screenshots to showcase some of the features. FlockBase aims to make tracking church finances simple for both staff and volunteers.

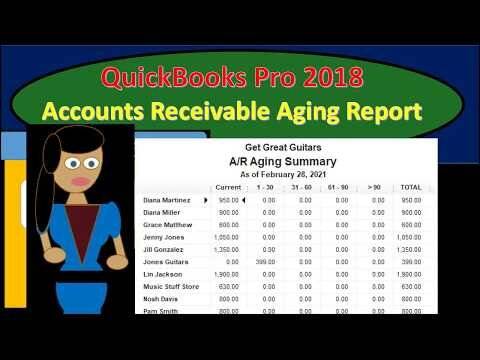

- By using class and location tracking, users can configure QuickBooks Online for church accounting.

- Many churches make the mistake of not classifying deposits and expenses correctly.

- Enter the date, the amount of the deposit, and the income account it belongs to (e.g. General Fund Contributions, Building Fund Contributions, etc…).

- MIP Fund Accounting can also handle complex financial reporting, including government and grant reporting, as well as the flexibility to customize reports to meet the specific needs of their organization.

- Money moving throughout the accounting books from a church usually come from donors, fundraising activities, or grants/funds received from a variety of sources.

Remote work has expanded across nearly every field, including bookkeeping. If you find someone who is a good fit for your business needs, it doesn’t matter if they are in California while you work from New York. You’ll want to create a contract that outlines details, such as deadlines, rates and expectations so that everyone is on the same page. Bookkeeping tasks provide the records necessary living wage calculator to understand a business’s finances as well as recognize any monetary issues that may need to be addressed. Proper planning and scheduling is key since staying on top of records on a weekly or monthly basis will provide a clear overview of an organization’s financial health. While any competent employee can handle bookkeeping, accounting is typically handled by a licensed professional.

Best Church Accounting Software Of 2024

The goal here is to be able to show those who are contributing to the church that the money is going where it was designated to go. This is important because the church’s revenue is mostly generated by tithing, contributions, and donations. If those who contributed became unhappy as to how the money was being handled, then this would put future contributions in jeopardy. Churches have to abide by tax codes just like other nonprofits and for-profit businesses.

As a desktop program, you’ll only pay a one-time fee for the installation—no month-to-month contract. Moreover, PowerChurch Plus doesn’t need an internet connection to run, and you can install it on as many desktops or laptops in your church. IconCMO’s scores in our evaluation are almost head-to-head with Aplos except for pricing and ease of use.

PowerChurch Plus

Just enter hours worked and QuickBooks automatically calculates taxes and deductions. Whether you’re presenting in a monthly meeting to congregants or delivering financial presentations to the board or committee, it’s easy to create the right report for each audience. There are dozens and dozens of bookkeeping options available and the choices may seem overwhelming. We’ve analyzed and rated the best online bookkeeping services to help you make the best decision when choosing the right one. To access and use the Services, you must register and create an account. By registering or creating an account, you agree to provide accurate and complete information and to inform us of any changes to that information.

- Since the two have different objectives, it only makes sense that they have different bookkeeping practices.

- In this article, I reviewed the best church accounting software on the market right now, including information about how they work, what each does best, key features, and integration lists (where applicable).

- As a church accounting and bookkeeping manager, you have to recognize the sources of revenue in the church, which are mostly contributions.

- We’ve created this buyer’s guide with you in mind and ranked our favorites, but there is no one-size-fits-all solution, so be sure to investigate these on your own to see which will best meet the needs of your church now and in the future.

- The church accounting system should be aware of these methods to find the best solutions to track them.

And our setup process ensures every invoice is paid on time every time. We manage your church’s finances and help you keep every dollar on His mission. You’re afraid you’ll find out you (or someone you trust) made a church accounting error and put your church at risk. You’re unable to present your church’s finances to supporters with the same passion as the Scriptures. There are some useful tips that will make managing the church accounting system a little easier. Churches rely on contributions as a way to support their goal of benefiting their congregation and community, and any revenue generated, goes back into the church to further the cause.

QuickBooks

She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS. Church accounting is the planning, organization, and recording of the financial transactions that take place within the church. Unlike for-profit businesses, churches don’t exist to make a profit. Instead, they focus on activities that support the congregation and members of the society. For this reason, their approach to accounting is a little different.

There are no trials, subscriptions, or hidden fees.Wave’s optional paid features include online payment processing, payroll software, and access to personalized bookkeeping services and coaching through Wave Advisors. If you’re interested in using payroll software, you can start a free 30-day trial when you sign up for Wave. Our expense tracking and business reporting makes it easy for you to understand your church’s finances. You can categorize costs, and compare fundraising numbers, yearly donations, and services provided so you can find opportunities to do even more good work. From donations and tax receipts, to fundraising, taxes, and room rental, churches can have complex accounting requirements.

If a CPA will just take a few moments to browse our User Guide, the CPA will quickly understand how our software works and should be able to help you transfer your beginning balances into our software. No problem, FlockBase Accounting allows you to split a check or deposit among as many incomes or expense accounts as you need. Do you want to reconcile your checkbook to your bank statement (which is always a very good idea), no problem? FlockBase Accounting has a screen that allows you to easily reconcile the checkbook to the bank statement by clicking off the checks and deposits that cleared the bank statement. If the church currently has a CPA, you need to be in frequent contact with them as the bookkeeper of the church.

Customer Service

Church accounting and bookkeeping involve keeping a record of the dates and the amount of all transactions, planning the tax wisely, managing financial affairs, consulting different services, and many more. The simple single-entry method works perfectly for churches since they don’t have to record profit and loss. In fact, with church management software like ChurchPad, you can handle church bookkeeping easily.

この記事へのコメントはありません。